If you’re looking to increase client engagement in 2018, you may want to consider indexed universal life (IUL). Here are three ways to discuss IUL as a tax-efficient retirement vehicle with your individual and business owner clients.

- Converting qualified retirement dollars to tax-efficient dollars, what’s known as the retirement reboot;

- Funding nonqualified deferred compensation plans and executive bonus plans; and

- College planning.

- Retirement Reboot

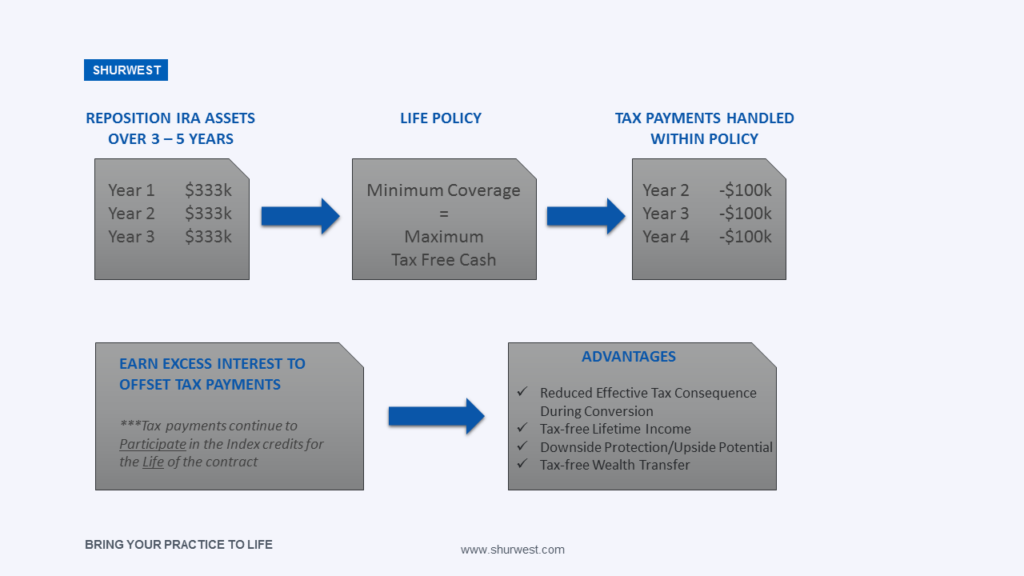

You may already know about the retirement reboot. In this strategy, a client’s tax-deferred, qualified retirement account is systematically transferred, generally over a period of three to seven years, to a tax-efficient alternative, in this case an IUL policy. The cash value that builds up in the policy can be used for tax-free loans and withdrawals as long as the policy is not classified as a modified endowment contract, or MEC.

Below is an example of a $1 million qualified retirement account transferred over three to five years.

- Deferred Compensation Plans

There are several ways to use IUL as a funding tool for other nonqualified deferred compensation plans and executive bonus plans. In one example, a business owner can use an IUL policy as key person coverage for an important executive or leader within the company, providing a death benefit in the event of an unexpected death.

The business buys the IUL policy which will provide death benefit coverage and access to any accumulated cash value (there may be an additional charge to waive the surrender fees). The covered executive does need to apply and qualify for coverage prior to policy issuance.

The policy also acts as a nonqualified deferred compensation plan in that the company can take out loans and withdrawals from the cash value for the executive to use in retirement. While, the income the executive receives is considered a taxable compensation benefit, it does allow the executive to save more for retirement above the limits on contributions to qualified savings plans. And since the compensation is deferred, it isn’t included in provisional income when calculating Social Security taxes.

- College Funding

An IUL policy can help pay for a college education and allow a student to qualify for more grants and aid. That’s because cash value life insurance isn’t one of the assets counted on the FASFA (the Free Application for Federal Student Aid) financial aid form. How much aid a student qualifies for depends on a family’s Expected Family Contribution, a calculation made by the federal government based on the FAFSA.

In contrast, 529 plans – tax-deferred college savings plans – generally count as an asset on the FAFSA. And if the money isn’t used for qualified higher education expenses, earnings are subject to federal income taxes. A federal penalty tax and possibly state and local taxes may also be added. If the beneficiary does get a scholarship, that amount may be withdrawn without the penalty but is still subject to other applicable taxes, including federal income tax.[1]

With IUL, the policy is funded through graduation with premium payments and the tax-free growth of the cash value can be used for college expenses, among other things. Once the IUL policy’s premiums are fully paid the policy becomes a tax-free retirement vehicle.

Consider the possibilities of Indexed Universal Life in 2018.

For more information contact the Shurwest Life Team at 800.355.0581

FOR FINANCIAL PROFESSIONAL USE ONLY – NOT FOR USE WITH THE PUBLIC

[1] “What is a 529 Plan,” Fidelity Investments. 433515.11.2This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state, or local tax penalties. There are additional tax implications that may be involved with each of these strategies. Any discussion regarding tax and legal matters should be discussed between your client and their tax adviser or attorney.

The strategies listed offer a specific result that is designed to help clients achieve certain financial goals. The limitations of each strategy should be weighed along with the potential benefits. Not all strategies can be combined or will apply to a specific client situation. It’s important to note that any policy loan or partial surrender will reduce or potentially eliminate the insured life insurance benefit and may reduce the value of any other optional benefits.

[1] “What is a 529 Plan,” Fidelity Investments. 433515.11.2