Contributed by Benjamin Bimson, CIMA®

Investment Advisor BCJ Financial

This week we attended the Schwab Impact 2015 conference in Boston, MA. The Impact conference is a huge one and is not only well attended, but includes many of the industry’s top minds and strategists along with the best technology providers all sharing their thoughts and ideas. We divided and conquered in order to gain the maximum exposure to the varied presentations throughout the week.

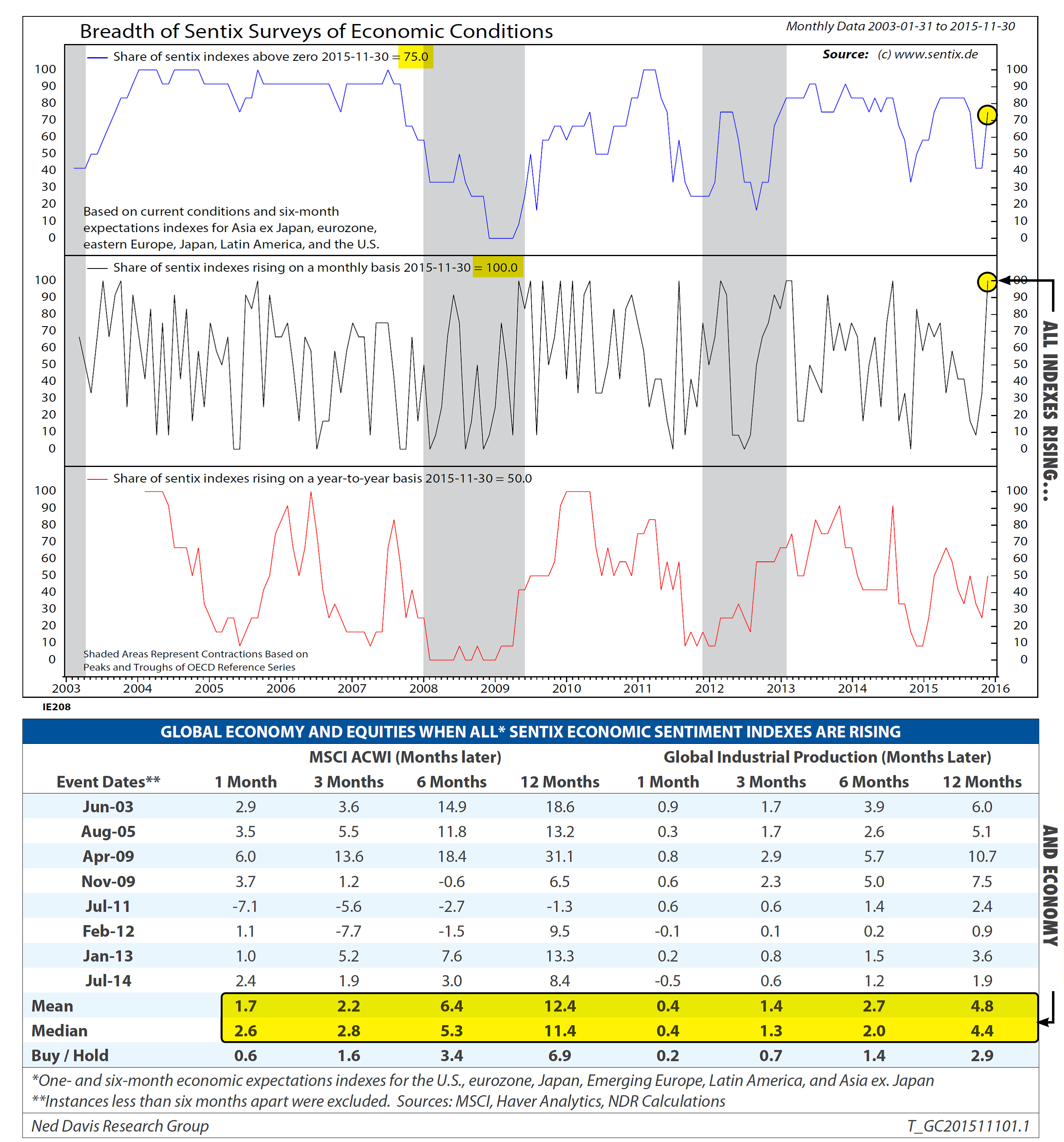

And what a week in the markets it was! Markets seemed to be full steam ahead only a couple weeks ago and now a pullback. Why? Honestly, it is most likely due to getting a little overbought since the rally began in late September. When the markets switch from extreme pessimism to extreme optimism as seen below we can expect big moves in the market. You can see the switch in the chart below.

A pullback can be healthy when we are overbought. This is because faster than normal run-ups are often followed by faster than normal draw-downs. Basically the theme of some of the great minds in money management this week was the same. Jeffery Gundlach, William Priest, Mario Gabelli, Howard Ward, Mark Hamilton, Andrew Lo, Consuelo Mack, George Serafeim, and Liz Ann Sonders were just some of the industry leading presenters at this event. They all were talking about transition for fixed income and the probability of rate hikes beginning in December. Stock markets are likely to grow, but at a slower pace than they have in the past with greater volatility. There are some things to keep an eye on and some things that are reasons for hope. It is always a good idea to get both sides of the story from those who are extremely optimistic and those who are cautious. Reality often lies somewhere in-between.

The good news is that a recession is not looking likely. Economic data continues to support the idea that while we may be in the midst of a slowdown, we are not at recessions door at this time. The economic leading indicators are improving. This is a positive sign in light of all the concern over high PE ratios and earnings slowdowns.

It is important to remember that things will change quickly as we approach the December rate liftoff. Although the bond market is coming to grips with rate hikes, equities may falter from time to time and may even dip down to pre-recovery levels. It is best to maintain a cautious approach until things get a bit clearer direction wise. We will continue to monitor macroeconomic themes, global trends, the Fed and market conditions. We continue to be somewhat cautious in all aspects and especially in rate sensitive assets.

Securities offered through World Equity Group, Inc. Member FINRA/SIPC. Advisory Services offered through BCJ Capital Management. World Equity Group, Inc. and BCJ Capital Management are independently owned and operated. The information contained in this electronic message and any attachments to this message are intended for the exclusive use of the addressee(s) and may contain confidential or privileged information. No representation is made on its accuracy or completeness of the information contained in this electronic message. If you are not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this e-mail and any attachment(s) is strictly prohibited. Please reply to the sender and destroy all copies of this message and any attachments from your system. BCJ recommends that you do not send confidential information to us via electronic mail. Such information may include, but is not limited to, social security numbers, account numbers, and personal identification numbers. The delivery of electronic mail cannot be assured. Therefore, BCJ will not accept time-sensitive or action-oriented messages delivered to us via electronic mail, including authorization to “buy” or “sell” a security, or instructions to conduct any other financial transaction. All e-mail sent to or from this address will be recorded by BCJ’s email system and may be archived, reviewed or monitored by someone other than the recipient.

Investment Management Consultants Association is the owner of the certification mark “CIMA®,” the service marks “Certified Investment Management Analyst (SM) ,” “Investment Management Consultants Association (SM),” and “IMCA (SM).” Use of the CIMA® or Certified Investment Management Analyst (SM) signifies that the user has successfully completed IMCA’s initial and ongoing credentialing requirements for investment management consultants.