By: Joe Niedzielski

New Fee-Based Options for RIAs Helped Position FIAs as Alternative Asset Class

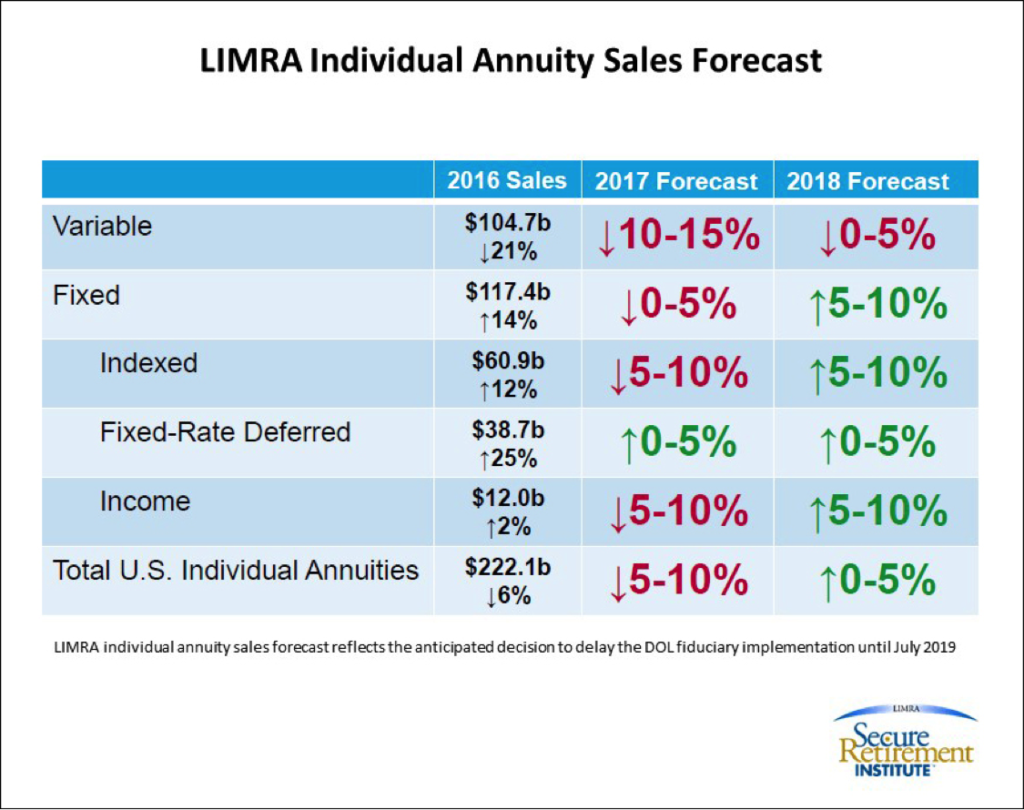

As we head toward year-end, the outlook for sales of fixed indexed annuities (FIAs) appears brighter. After posting record sales of $60.9 billion in 2016, up 12% year-on-year, uncertainty over implementation dates for the Department of Labor’s fiduciary rule and its potential impact on independent distribution organizations contributed to a slower sales pace for FIAs during the first few months of 2017.

But the pace of sales growth picked up during the second quarter. And with the subsequent announcement of the delay in the implementation of the DOL’s fiduciary rule, FIA sales for 2018 are now forecast to reach the levels they experienced in recent years.

Through June 2017, FIA sales were down 8.0% compared to the same period in 2016, according to figures from LIMRA, the worldwide life insurance industry trade group. Yet, FIA sales rose 15% in the second quarter compared to the first quarter. And with the delay in the implementation of the DOL’s fiduciary rule, LIMRA released revised sales forecasts in mid-October. The group’s forecast now sees FIAs back to a 5%-10% growth pace in 2018, near the record levels of 2016.

You would have to go all the way back to 2001 for comparable production numbers as those experienced by annuity writers in the first half of 2017. Total annuity sales were down by 10% to $105.8 billion, however, an emerging sales trend – the shift from variable products to fixed annuities continues – the LIMRA figures also show. The overall fixed universe, including FIAs and fixed deferred annuities, outpaced variable annuity sales for the sixth straight quarter, something that hasn’t happened in more than 25 years, LIMRA noted.

While the fiduciary rule wasn’t fully implemented in 2017, carriers did introduce product changes with both the rule in mind and as a means to attract new advisors to their products. These include level commissions on products with different surrender schedules and fee-based options. The latter change also helped broaden FIAs’ appeal to registered investment advisors and fee-based advisors, and their need for an alternative product to hedge the risk of their clients’ traditional portfolios.

If you’re looking for a tool to help position the discussion with clients about adding FIAs to their retirement portfolio consider the Nationwide Retirement Portfolio Risk Calculator®. In 2016, Annexus, our partner, worked with Nationwide and Morningstar Investment Management to analyze the impact of adding the Nationwide New Heights® fixed indexed annuity to a traditional equity and bond portfolio. The result is the risk calculator – a way to show clients that adding New Heights to an equity and bond portfolio could help improve the risk-adjusted returns of their retirement portfolio.

Sources:

http://www.limra.com/Posts/PR/Data_Bank/_PDF/2017-2Q-Annuity-Estimates.aspx

https://www.nationwide.com/about-us/071117-summit-fee-based.jsp